|

Latest Posts By WanSiTong

- Master

|

|

| 15-Nov-2013 12:56 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

2 short of 1.......ko a sai zao leh..........Lol

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15-Nov-2013 10:51 |

Midas

/

Midas

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15-Nov-2013 10:43 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Corporate News F& N: Some bonds fail to get votes. coupons at the extraordinary resolution tabled at the meeting yesterday for the holders of the various bonds and notes held by F& N Treasury. Specifically, the required quorum was not achieved at the meeting of the holders of the sevenyear bonds they hold an outstanding S$80m worth of 3.15% bonds due 2018. The extraordinary resolution for the five-year bonds on the other hand - S$220.0m of 2.48% bonds due 2016 - was passed without amendment. The meeting for the holders of the seven-year bond has thus been adjourned and is expected to be reconvened on 29 November. The vote fell through for higher-rate(Source: The Business Times)GLP: Sets up US$3b fund 2QFY14 net profit falls 26% yoy. Properties announced the establishment of a US$3b China Logistics Fund, even as net profit fell 26% yoy to US$145m in 2QFY14. This was on the back of revenue falling 19% yoy to US$140m (2QFY13: US$173m). The fund, which is the largest of its type in the world, is focused on the development of logistics infrastructure in China. GLP will seed the fund with land to support 1.8m sqm of leasable area. In addition, a US$1b credit facility has been secured from China Merchants Bank to fund development activity in China. As the asset manager, GLP will retain a 56% stake in the fund. Times) Global Logistic(Source: The BusinessOxley: Buys prime freehold land in Kuala Lumpur. overseas acquisition in Kuala Lumpur in May, Oxley Holdings, which has been making headlines for its choice global investments, is adding yet another trophy to its stash. The latest is a plot of prime freehold land measuring about 12,575sqm, located within the Kuala Lumpur City Centre area. Oxley picked up the site, which houses six bungalow buildings at 149-159 Jalan Ampang, for RM446.7m (S$174m) from an estate sale. The group intends to redevelop the land, subject to obtaining all the necessary approvals. Times) Following its first(Source: The BusinessParkson Retail Asia: 1QFY14 net profit down 11% yoy. Asia's net profit for 1QFY14 slipped 11.4% yoy to S$10.26m. Revenue was 4.1% lower yoy at S$108.73m on the back of a challenging retail environment. The group expects operating results to improve in the coming quarters, boosted in part by the year-end holiday season. (Source: The Business Times)Thai Beverage: 3Q13 net profit tumbles. fell to Bt4.08b (S$161.01m) from Bt15.68b baht a year ago. Revenue came in at Bt35.04b, down from Bt37.58b in 3Q12. Thai Beverage net profit for 3Q13(Source: The Business Times)UE: 3Q13 net profit down 2% yoy at S$12.5m. net profit of S$12.5m for 3Q13, down 2% yoy. Revenue more than quadrupled to S$732m due to consolidation of the results of WBL, which it took over earlier this year. The higher revenue was also due to increased rental income from the group's properties and engineering and construction subsidiary UE E& C. The lower margins were caused by losses incurred by WBL's listed technology subsidiary Multi-Fineline Electronix. WBL was also hit by lower car sales and

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15-Nov-2013 10:40 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

What?s in the Pack Rotary Engineering- Key takeaways from results briefing (RTRY SP/BUY/S$0.66/Target: S$0.88) Rotary reported a stronger set of results for 9M13. Net profit rebounded to S$16m from a loss in 9M12, mainly due to higher revenue and lower? Rex International- Encouraging progress from Rexonic well stimulation (REXI SP/BUY/S$0.66/Target: S$1.27) In the results briefing, we were encouraged by news that Rexonic has signed contracts to provide the eco-friendly Rexonic solution to three MNCs till 2016. Overseas Education- 9M13 results in-line. Potential upside to student capacity at new campus (OEL SP/BUY/S$0.81/Target: S$0.94) Maintain BUY with a slightly higher target price of S$0.94, based on our 3-stage DCF model. The implied 2014F PE is 15.8x. Olam International- 1QFY14: Seasonally weak quarter. (OLAM SP/HOLD/S$1.50/Target: S$1.60) Maintain HOLD with target price of S$1.60 based on FY15F PE and a 30% discount to Olam?s long-term forward PE of 16.1x (or equivalent to 1SD below long-term mean PE). Singapore Telecommunications- 2QFY14: Overseas businesses suffer from currency depreciation. (ST SP/HOLD/S$3.78/Target: S$3.68) Maintain HOLD. Our target price is S$3.68, based on sum-of-the-parts methodology. Bumitama Agri-Revision on FFB production growth guidance to 17% from 25% on weaker-than-expected recovery in production (BAL SP/BUY/S$0.985/Target: S$1.23) Maintain BUY and target price of S$1.23, based on 14x 2014F PE. We like BAL for its young age profile and best OER to support its 5-year net profit CAGR of 32%. ST Engineering (STE SP, S63) ? Technical SELL with +4.2% potential return The stock is likely to trend lower as it has hit our SELL target of S$3.95 mentioned on 24 Oct 13 in the last trading session? SingHaiyi Group (SINX SP, 5CE) ? Technical BUY with +39.1% potential return The stock looks poised to rebound as it is still trading above its 200-day EMA and has closed above its 50-day EMA. A higher low has?. Indofood Agri Resources (IFAR SP, 5JS) ? Technical BUY with +11.1% potential return The stock is likely to trend higher as it has closed above S$0.85 which was the bullish trigger level mentioned on 22 Oct 13... UOBKH |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15-Nov-2013 06:30 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

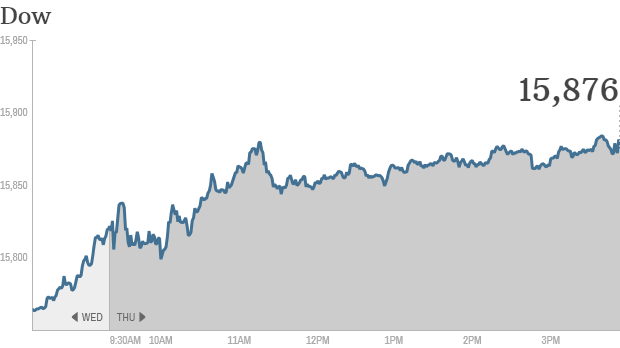

Stocks up again: Dow 16,000 in sight

Click the chart for more stock market data. Stocks ended modestly higher Thursday after Federal Reserve chair nominee Janet Yellen indicated in a Senate hearing that she will continue to support the economy with stimulus measures.Investors were encouraged and sent the Dow Jones Industrial Average and S& P 500 to new records. The Dow is now just 1% from hitting 16,000, while the S& P 500 is less than 1% from 1,800. The Nasdaq lagged behind the other two major indexes, as a drop in Cisco (CSCO, Fortune 500) shares weighed on the tech-heavy index. But the Nasdaq also rose slightly. It is now at its highest level since September 2000 and is less than 1% from 4,000. Investors have been looking for clues as to when the Fed may begin scaling back its bond purchases. There has been speculation that the so-called tapering could begin as early as next month. But during her question and answer session on Capitol Hill, Yellen said that the bond-buying program could still help the economy. " It's important not to remove support, especially when the recovery is fragile," she said. " I believe it could be costly to withdraw accommodation or to fail to provide adequate accommodation." The comments appear to have convinced investors that Yellen would continue the Fed's current $85-billion-per-month bond-buying program for the next few months. The program -- also known as quantitative easing or 'QE' -- has helped spur stocks by pumping markets with extra cash. Related: Fear & Greed Index still shows greed Related: Japan's economy slows dramatically European markets ended with modest gains following the news that the eurozone economy grew by 0.1% in the third quarter, in line with economists' expectations. Asian markets closed higher. A weaker yen helped Japan's Nikkei jump 2.1%. The currency eased after a report showed Japan's economy grew 1.9% in the third quarter - a sharp slowdown from the previous quarter |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15-Nov-2013 06:24 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

World MarketsNorth and South American markets finished broadly higher today with shares in Brazil leading the region. The Bovespa is up 2.34% while Mexico's IPC is up 1.80% and U.S.'s S& P 500 is up 0.48%.

North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 23:22 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

It's a win-win solution.........parent Company of F& N also need money........Lol

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 22:50 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 22:48 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 22:44 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 22:33 |

Elite KSB

/

Elite KSB

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

If I am the SSH, I will sell all the way down to ZERO.........mic high lang........Lol

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 22:30 |

Elite KSB

/

Elite KSB

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

The SH will wake up one day..... Lol

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 22:27 |

CapitaLand

/

Capitalmalls Asia cheong more than Capitaland ?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

The parent is lucky enough to have such a bright son.............Lol | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 22:08 |

Midas

/

Midas

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

3Q turn around from loss of Rmb 6.1m last year to profit of 16.4m this year............ good or not?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 21:46 |

Midas

/

Midas

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Outlook According to the China Railway Corporation (" CRC" ), China?s national railway operator, railway fixed asset investments for the first nine months of the year reached RMB369.7 billion, which was a 7.4% increase from the previous corresponding period. This follows an earlier announcement by the CRC that it will be raising annual investments in fixed assets to RMB660 billion in 2013. In China?s 12 " The Chinese Government?s continued focus on developing the PRC railway network will definitely generate opportunities for industry players. Accordingly, we are optimistic that Midas will be able to leverage on its leadership position in the PRC market as well as NPRT?s capabilities to secure further growth. Our strategy remains unchanged, and the Group will continue to harness growth opportunities in the PRC and exports to generate value for our shareholders," Mr Chew concluded. th 5-year plan for railway development, China will have around 123,000 km of railways in operation by 2015, including 18,000 km of high-speed railways and an express railway network totaling 40,000 km in length. The CRC plans to have approximately 5,500 km of new railway lines put in operation by end 2013, extending the size of the rail network to over 100,000 km, while the high-speed rail network will exceed 10,000 km. |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 21:37 |

Midas

/

Midas

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

3Q 2013 : Profit after Tax RMB 16.4m (2012 : Loss 6.1m) 9 mths 2013 : PAT 26.4m ( 2012 : 10.7M) NAV : Rmb 2.42 Following the PRC Government?s pledge to speed up railway investment, China Railway Corporation (" CRC" ), China?s national railway operator, said in October that railway fixed asset investments for the first nine months of the year reached RMB369.7 billion which was a 7.4% increase from the previous corresponding period. CRC had also earlier announced that it will be raising annual investments in fixed assets to RMB660 billion in 2013. 繼 中 國 政 府 承 諾 加 快 鐵 路 投 資 後 , 中 國 鐵 路 總 公 司 於 十 月 份 公 佈 今 年 頭 九 個 月 的 鐵 道 固 定 資 產 投 資 達 人 民 幣 3,697億 元 , 比 去 年 同 時 期 增 長 7.4%。 中 國 鐵 路 總 公 司 早 前 也 曾 宣 佈 在 二 零 一 三 年 將 增 加 年 度 固 定 資 產 投 資 達 人 民 幣 6,600億 元 。 According to the country?s 12 按 國 家 第 十 二 個 五 年 計 劃 之 鐵 路 建 設 規 劃 , 中 國 在 二 零 一 五 年 投 入 營 運 之 鐵 道 將 達 至 約 123,000公 里 , 其 中 包 括 18,000公 里 的 高 速 鐵 道 和 總 長 達 40,000公 里 的 特 快 鐵 路 網 絡 。 中 國 鐵 路 總 公 司 預 計 在 二 零 一 三 年 底 新 增 投 入 營 運 之 鐵 路 約 5, 500公 里 , 鐵 路 網 絡 規 模 將 延 長 至 超 過 100, 000公 里 , 高 速 鐵 路 網 絡 將 超 過 10,000公 里 。 Such positive developments are expected to benefit industry players and the Group remains moderately optimistic on the outlook of China?s railway industry over the mid to long-term. Further, the Group?s order book has also received a healthy boost of approximately RMB433.6 million between July and October, backed by contracts from international and PRC customers, as well as the Group?s first high-speed train contract since 2011. 這 些 正 面 發 展 預 計 將 令 業 者 們 受 惠 以 及 本 集 團 仍 然 對 中 國 鐵 道 行 業 的 中 長 期 前 景 持 適 度 樂 觀 的 態 度 。 此 外 , 集 團 的 總 訂 單 於 七 月 份 至 十 月 份 之 間 取 得 約 人 民 幣 4億 3,360萬 元 的 健 康 增 長 , 主 要 受 惠 於 海 內 外 客 戶 所 頒 發 的 合 同 以 及 集 團 自 2011年 獲 得 的 首 單 高 速 列 車 合 同 。 At the export front, the Group continues to make good progress in its strategy to grow its businesses, securing additional projects for the European, Russian and Singapore market in 2013. Moving forward, the Group will continue to actively identify and harness opportunities in other product segments as well as in export markets. 集 團 在 發 展 其 出 口 市 場 業 務 的 策 略 上 繼 續 取 得 良 好 的 進 展 , 於 二 零 一 三 年 在 歐 洲 、 俄 羅 斯 及 新 加 坡 市 場 獲 得 額 外 的 項 目 。 展 望 未 來 , 本 集 團 將 會 在 其 它 產 品 領 域 及 出 口 市 場 繼 續 積 極 地 物 色 及 爭 取 機 會 。 th 5-year plan for railway development, China will have around 123,000 km of railways in operation by 2015, including 18,000 km of high-speed railways and an express railway network totaling 40,000 km in length. The CRC plans to have approximately 5,500 km of new railway lines put in operation by end 2013, extending the size of the rail network to over 100,000 km, while the high-speed rail network will exceed 10,000 km.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 21:10 |

Attilan

/

could it be takeover rumour for Asiasons capita?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

3Q 2013 Profit : 33.2m ( 2012 : Loss 5.6m) 9 mths 2013 Profit : 31.6 m (2012: Profit 16.8m) *Subsequent to the end of reporting date of 30 September 2013, the price of quoted securities which the group has a significant stake experienced a sharp decrease in market price. Based on quoted securities price as at the close of 12 November 2013 and assuming that the quoted securities continue to trade at around this price level, the negative impact arising from fair value loss on the Group?s results for Quarter 4 ending 31 December 2013 would be approximately S$106 million.

The slowdown in the economic growth of China through affecting the South East Asian Countries export driven economic growth, has caused a shift towards domestic consumption and reducing the reliance on exports. In the coming months, the Group will continue to focus its strategy in Indonesia, Thailand, Malaysia and Singapore where the consumer consumption is still relatively strong.

The events immediately after the end of reporting date as at 30 September 2013 had caused a sharp decline in the share price of the Company. The Company expects to face challenges in its fund raising activities in its fund management business in the coming months ahead.

For the significant events after the end of reporting date of 30 September 2013, the management would also like to refer to the announcements made by the Company on 17 October 2013 ?Proposed Acquisition of 27.5% of Class B units in Black Elk Energy Offshore Operations LLC? and on 30 October 2013 ?Proposed Convertible Loan Facility of up to S$25 million?. |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 17:30 |

Olam Intl

/

OLAM_OLAM

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 17:21 |

Swiber

/

Swiber

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Swiber Holdings - In ?restart? modeWritten By Stock Fanatic on Thursday, November 14, 2013Core earnings for FY14 could decline due to the lack of orders in 2013, which, in addition with suppressed margin, brings Swiber back to where it was post GFC. The c.US$100m net proceeds from the Kreuz divestment will make hardly a dent in its high net gearing of 0.9x.

With few jobs for execution in India and the monsoon season in Southeast Asia, 4Q13 revenue could dip qoq, resulting in negative operating leverage (c.US$240m operating expense/quarter).

Order lacklustre

With no contracts secured in 3Q13, the order book has declined 33% qoq to US$900m (50% to be booked in FY14), which could impair FY14-15 earnings visibility. Swiber attributed the weakness in contract awards in 2013 (FY12: US$1.2bn) to the shifting of bid timelines by customers. The tender book, however, is still strong at about US$2bn. We cut our order target for FY13 from US$800m to US$500m but keep FY14 at US$800m.

Technical Analysis

Kreuz not a done deal

The divestment of Kreuz at about 6x CY14 P/E is deemed to be unattractive and we believe there is a chance that the deal may not go through, subject to the EGM in Dec 13. (Read Report)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14-Nov-2013 16:42 |

Elite KSB

/

Elite KSB

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Lol........ chicken farm bouey toh!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| First < Newer 141-160 of 1632 Older> Last |